How to Pay for a Kitchen Renovation

Depending on the size and scope of your kitchen upgrade, the final bill can total in the thousands or even tens of thousands of dollars. Most people don’t have that kind of cash just lying around. So how can the average homeowner pay for such a huge investment in their home’s future? There are several different options.

Kitchen Remodeling Costs

The first option is to save. If you can delay your kitchen renovation for some time in the future — 12, 18, or even 24 months, for example — it may be possible to lay away a little money every month so that when it finally is time for the construction project to begin you already have the money to pay for it.

Then there are home loans you may be able to use. A good place to start is the lender that holds your mortgage. You may be able to get a loan against the equity you already have in your home. Or you may be able to refinance your home, lowering your monthly mortgage payment while getting additional cash to invest in your kitchen upgrade.

Talk to the bank you use for your everyday banking. They may be able to offer additional ideas on how to come up with the money to pay for your kitchen upgrade.

Mr. Kitchen

Generally, a kitchen remodeling project is a good investment in the future value of your home — especially if your current kitchen is small, inefficient, or outdated. The kitchen is one of the most important rooms that potential buyers look at when considering buying a home. So when yours is modern, updated, and recently renovated, it often can bring up the overall value of your entire home.

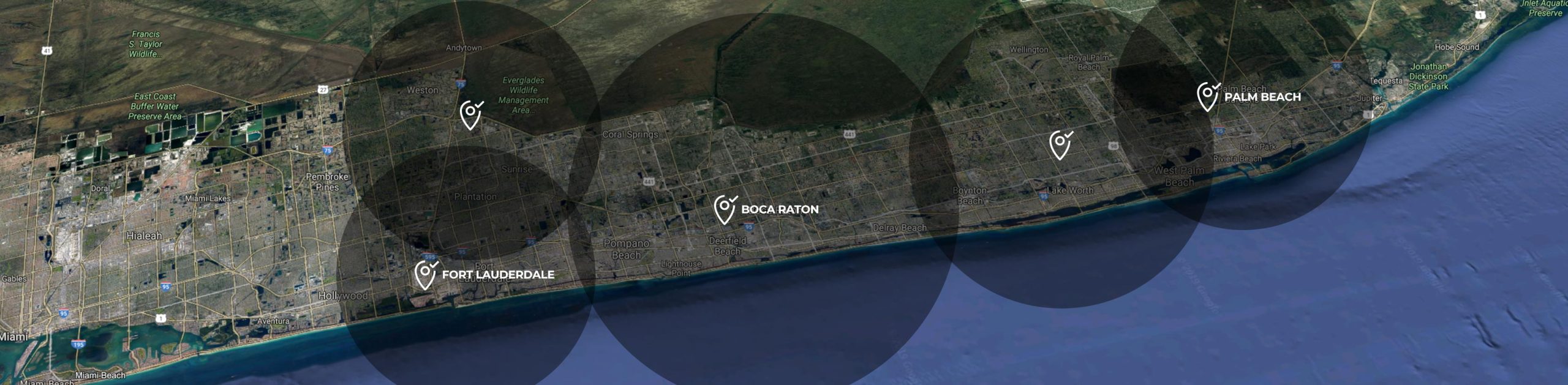

At Mr. Kitchen, we’ve spent the past decade building kitchen renovations South Florida homeowners can be proud to show off to their family, friends, and neighbors.